A New Wave of Innovation in Fintech

Michael Wilkerson, founder of Tugende, provides insights on the untapped potential of African tech talent and how he’s using technology to scale his enterprise in the booming fintech sector.

As a 19 year-old Stanford University student, Michael Wilkerson visited Kampala to embark on an internship at Uganda’s Daily Monitor newspaper. It was during this trip that two of his greatest passions were born: his love for Uganda and his appreciation for boda bodas (motorcycle taxis). In just a few months, the seeds for his social enterprise had been planted.

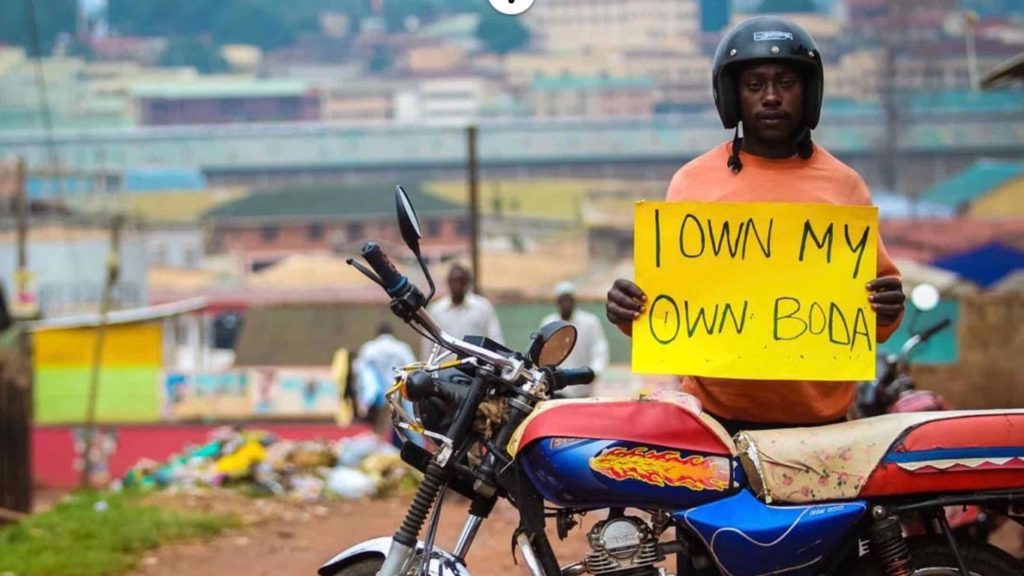

Tugende started as a side hustle for Michael, providing financing to boda boda drivers through a lease-to-own agreement that helps them own their motorcycles in eighteen months or less. Betting on an industry deemed too risky by traditional lenders, his innovative enterprise quickly grew, making a profound impact on tens of thousands of self-employed entrepreneurs.

Today, Tugende has established itself as a leading Micro, Small and Medium Enterprise (MSME) lender in East Africa, expanding its offering to include digital training, life and medical insurance, and a range of asset finance products to actively support entrepreneurs in reaching their ownership goals. This is no small feat, considering that 90% of African businesses are MSMEs yet receive less than 20% of total available credit. Thanks to its tech-enabled business model, Tugende is tackling the $331 billion gap left by traditional banks.

We caught up with Michael at the 2022 Doha Forum to hear his thoughts on the untapped potential of African tech talent and how he’s using technology to scale his enterprise in the booming fintech sector.

Tell us a bit about your journey as an entrepreneur. Why were you motivated to start Tugende?

Like with any other business, starting Tugende was tough. But we have to acknowledge that I’m a white Stanford-educated man, so even when I was struggling to raise funds, I had a headstart on the average entrepreneur. Literally, one of my first angel investments came from my former roommate who went to work at Google as an engineer at age 23 and could afford to write a $10,000 check! So there were some definite advantages to getting capital.

In the first years, I was looking for $100,000 — which is small in the world of scaling businesses today — and I was able to find it. It was hard, but I got it mostly from networks in the US. This made it evident to me that there’s a huge need for dormant capital in the US and other developed markets to serve enterprises in places like Uganda and Kenya. So in a way, I was able to be a conduit for that, but that’s definitely an advantage early stage startups founded locally haven’t always had. I think that gap is starting to be bridged more and more today, and I’m happy to see that.

The people who can succeed today, build wealth today and create jobs today are going to provide more livelihoods for the young people of the future.

The other thing about the Tugende journey is that it was completely organic; we didn’t start with a business plan created at an MBA school and then decide on a country to parachute into. I started working in Uganda as a journalist intern at a local newspaper at age 19, and I just made a lot of friends with local journalists. I got to call ministers on their cell phones and also speak with Boda Boda riders — motorcycle taxi drivers who are now our core customers. Going out and talking to people was my job. It was a great way to learn, and in the process, I just fell in love with Uganda. The business really evolved out of that, and I think not having a 10 or 20-year strategic plan allowed us to learn and adapt.

Today, our business has changed from just helping people own instead of renting an income-generating asset like a motorcycle, which has always been our core. We believe that people should get the chance to build wealth. When you own, instead of rent, you can make twice as much money per day. So that was always a clear, compelling win-win, but what we learned over time was that we could do a lot more. As a platform, we felt that we should strive to remain partners of our clients for the next 10 or 20 years, because our successful clients are the emerging middle-class and potentially upper class in countries like Uganda who are creating jobs. With 70% of Uganda’s population under 25, the people who can succeed today, build wealth today and create jobs today are actually going to provide more livelihoods for the young people of the future than any international call centre.

You are passionate about empowering emerging African entrepreneurs. Why is this so important to you?

I like to think about investment as unlocking opportunity or taking risks. And that’s true in the way that we invest in our MSME clients, as well as how we invest in our staff and create opportunities for professional development. But we also need to think about that in terms of the investment landscape. Back in 2012, especially when it came to impact investment, it felt like the few investable companies especially in East Africa were being pitted against each other for a very small amount of capital. Both private equity and impact-oriented investing in Africa was coming from an aid mindset, and investors were the gatekeepers who decided the definition of ‘impact’.

Again, it’s great to see that landscape shift. Now we’re beginning to give more respect to the entrepreneur who takes the risk, finds the problem that needs solving and creates the opportunity. The investor then becomes the catalyst that moves that opportunity along.

Now, the African entrepreneurial landscape is being seen as an opportunity you don’t want to miss out on, not as a problem that we need to solve with international cash.

One of the motivations for me with Tugende has always been that a lot of charitable solutions don’t work, and they’re more designed to make the giver feel good than to create a lasting impact. This is significant to me because before I first went to Uganda, I had just read Jeffrey Sachs’ The End of Poverty, where he basically said we can eradicate poverty if we just push enough money to the right places, so I was really motivated by that. And he’s not wrong in one sense, which is that there is enough money in the world to fix these problems. But on my first visit to Uganda, I saw all kinds of shiny white UN SUVs and a lot of condescension from international people who were there to tell Ugandans what to do. That really rubbed me the wrong way. And as a journalist, who was literally there to learn from more experienced Ugandan journalists, it was quite a contrast. I think that really inspired me to take a learning approach. For investors, what’s different now from what we’ve seen in the last 10 years is that the African entrepreneurial landscape is being seen as an opportunity you don’t want to miss out on, not as a problem that we need to solve with international cash.

How is Tugende using technology to close the credit gap for the informal sector?

One of the biggest shifts for us at Tugende over the years has been how we use technology. We’ve always had technology at the core of our business because we didn’t want to have to do cash collections. We needed to gather data at scale, we needed to track people’s progress and we needed eventually to run a nationwide operation, including in rural areas. So we’ve experienced how technology allows you to deliver a complex business at scale. I think there are very few businesses in the world these days that are not using technology as part of their operations. But what we learned over time was that for both our staff and clients, Tugende doesn’t just provide financial inclusion; it provides digital inclusion too. So we’re helping people learn how to use a smartphone for the first time, learn to trust digital receipts just as much as paper ones, and learn to check something on our system without having to come to the branch.

As part of our mission, we want to help people not only own assets and move up significantly in livelihood, but we want to be there as a partner for the next 10 years. So the more that our clients can trust us and interact through our digital platform, the better and longer we can serve them.

We’ve experienced how technology allows you to deliver a complex business at scale.

When it comes to business in the informal sector, we’ve also realised that it doesn’t have to be purely digital or purely offline. We will always have a hybrid model because we disburse physical assets, and there has to be a place to collect them. So people who aren’t yet comfortable with the purely digital route have a branch to come to, and customers who have gotten more comfortable with the purely digital have that user journey as well.

What excites you about the possibilities of digital transformation?

One major thing: partnerships. Technology makes it so much easier to integrate with somebody else doing something cool. Just from talking to other entrepreneurs in The ROOM, we’ve found positive ways to collaborate instead of thinking that if there’s a little bit of overlap in the products we’re building, we better stay apart. There’s also that fact that we can deliver those services quickly and purely digitally without having to hire an entire new team to make those partnerships work. So accelerated digitisation will allow a lot of businesses to move faster, because not every business needs to have branches nationwide like Tugende does. If they have something else to offer, we can plug into it and we can both provide a better package to the end consumer.

As a founder at the cutting edge of fintech, are you seeing a growing demand for tech talent?

Absolutely. There are so many job opportunities globally that can be delivered from anywhere. If you talk to young people who have had their first smartphone for a year, the learning curve and the way they’re thinking about what they can do with technology just on a smartphone is incredible.

We’re already seeing an explosion of tech jobs seeking African talent. And of course it makes it hard for some of us who are incubating that talent and don’t want them to get poached. On the other hand, there are so many exciting opportunities for people to do digital work that also allow for creativity and huge potential for career growth. I think this is another way that we can bridge the capital gap between countries like Uganda and Kenya and countries in Europe and the US.

We’re already seeing an explosion of tech jobs seeking African talent.

Finally, how do you see Africa developing in the post-Covid landscape?

Right now, we’re seeing some of the worst case scenarios happen. With what the world has been through with the pandemic and even with some geopolitical events, collectively we’ve shown a lot of resilience. So I think the challenges that we’ve faced over the last few years and are facing today are going to incubate a new wave of innovation. We’ll definitely be celebrating progress in the future. What I’m excited about is what that progress will look like, because I think a lot of it will be things we can’t even visualise today.

Find out more about how The ROOM is connecting companies with the in-demand skills of the future through its pool of world-class talent.